ESOP

What is an Esop?

An Employee Stock Ownership Plan, or ESOP, is an employee retirement plan, which makes the employees of a company owners of stock in that company. The plan is governed by ERISA.

WHY DID CTL ENGINEERING START AN ESOP?

CTL Engineering, Inc. started their ESOP on April 1, 1990 anticipating transfer of ownership. That transition took place on January 15, 1999 when the employees purchased the Company from the previous owner.

HOW DOES THE ESOP AFFECT ME?

The ESOP gives you a vested interest in how your company performs. This interest will lead to ownership behaviors in your co-workers and in yourself. You may find yourself feeling more pride in your work and increasing your efforts to help the company perform better.

If the Company does well, the stock price will likely go up, including the shares the company gives you, but if the company does poorly, stock price will fall and your stock will not be worth as much. As owners, we can all benefit from the efforts of each individual employee.

Therefore, our ESOP gives all of us as employee owners extra incentive to make our Company prosper.

HOW CAN I AFFECT THE ESOP?

To affect the ESOP you must first realize that you are an owner and accept the responsibility of being an owner. You must understand that everything you do (or don’t do) affects the ESOP. The stock value increases with increased sales and profits. Working hard, minimizing expenses, minimizing errors, keeping a safe workplace and doing your best are all ways to enhance the stock value. Remember, the T in CTL stands for Teamwork.

What is Valuation?

A valuation is an annual appraisal by an independent expert to determine the worth of the Company. It is expressed as dollar amount per share.

HOW DO I PARTICIPATE?

To become a participant you must complete only one year of service. To receive a contribution for a plan year you must work at least 1,000 hours and be employed on December 31.

WHAT IS A CONTRIBUTION?

The Company has been making annual contributions to the plan. The contribution in recent years has been between 10 to 13% of W-2 wages. You must work at least 1,000 hours and be employed on the last day of the plan year, December 31, to receive a contribution. Any participant whose termination of employment occurs due to death, disability, or retirement still receives a contribution.

SOURCES OF EARNINGS

- Contributions & Sub S Distributions

- Stock Valuations

- Interest Earnings and Forfeitures

WHAT IS ALLOCATION?

Allocation is the annual division of contributions and forfeitures for the plan year (shares and cash) among all employees based on the allocation formula (1 pt for $1,000 in employee’s annual compensation and 2 pts for every year of service).

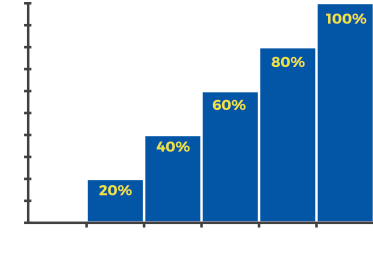

What is Vesting?

Vesting is the percentage of your ESOP account that you will receive if you leave the Company. It is determined by how many years of service you have completed as of December 31. It only takes six years to be 100% vested.

What are Forfeitures?

Vesting is the percentage of your ESOP account that you will receive if you leave the Company. It is determined by how many years of service you have completed as of December 31. It only takes six years to be 100% vested.

CAN I WITHDRAW CASH FROM MY ESOP ACCOUNT WHILE EMPLOYED?

YES, if you are at least 55 years old and 10 years in the ESOP or at age 65 if approved by the Company.

CAN I BORROW FROM MY ESOP ACCOUNT?

No.

Annual Statement Of Account

By June of each year, every participant receives a statement of his or her ESOP account.

When Do I get My Money After I Leave?

- Normal Retirement – at age 62 with 5 years of service

- Death

- Disability

- Other Termination – Other Termination – Your account will be valued at the end of the plan year in which you terminate. If your account balance is $25,000 or less, you will be paid out as quickly as administratively feasible. If your account balance is greater than $25,000, your account will be paid out over five years or as the administrative committee deems feasible.

What is a Distribution?

The payout of cash for the current value of shares and cash in your account after you leave CTL Engineering, Inc.

GLOSSARY

CONTRIBUTIONS

Either cash or stock added to the ESOP trust. Contributions come from the Company. The Company intends to make annual contributions to the plan. Contributions in recent years have been approximately 5% of eligible W-2 wages.

ESOP

Employee Stock Ownership Plan is a qualified pension / retirement plan governed by ERISA.

ERISA

Employee Retirement Income Security Act (1974) is a federal law that sets minimum standards for most

voluntary established pension and health plans in private industry and it provides protection for individuals in these plans.

FORFEITURE

Amount of non-vested stock and cash returned to the ESOP trust from employees who have left the company.

NORMAL RETIREMENT AGE

62 with 5 years of service

OWNER

An owner is an individual or entity holding stock in a company.

PARTICIPANT

A participant is an employee who meets all requirements of the plan to receive allocations from the trust.

PLAN YEAR

January 1 – December 31

SUMMARY PLAN DESCRIPTION (SPD)

A document intended to inform participants of important terms and provisions of the plan. The SPD is distributed to all new participants. Also available from the Human Resource’s Office.

YEAR OF SERVICE

A 12-month period during which an employee works at least 1,000 hours.

CONTACT INFORMATION

TRUSTEE:

C.K. Satyapriya (Chairman & CEO)

ESOP ADMINISTRATIVE COMMITTEE:

Ali Jamshidi

Jessica Donley

Joseph Stanley

Frederick Schoen

Dan Westphal

ESOP EDUCATION COMMITTEE:

Dawn Pressler

Jessica Donley

OUR MISSION STATEMENT:

Celebrate Ownership

Teach

Learn

ESOP INFORMATION:

ESOP e-mail: esop@ctleng.com

THE ESOP ASSOCIATION:

www.esopassociation.org

Toll Free 1-866-Fone-TEA